Staying on Top of Washington’s Patchwork Minimum Wage Increases in 2017 (And Paid Sick Leave in 2018)

Washington’s statewide and local minimum wages will substantially increase in 2017. While most employers are aware that Initiative 1433 raises the state minimum wage to $11.00/hour on January 1, 2017, the Initiative’s mandatory paid sick leave requirements (set to take effect in 2018) are not as well known. This advisory summarizes the main requirements that Initiative 1433 imposes on all Washington employers and compares the new state law changes to parallel requirements in local laws for Seattle, Spokane, Tacoma, and the city of SeaTac.

Initiative 1433: Minimum Wage

Washington voters passed Initiative 1433 in November, electing to raise the minimum wage statewide from $9.47/hour in 2016 to $13.50 by 2020:

- January 1, 2017: $11.00/hour

- January 1, 2018: $11.50/hour

- January 1, 2019: $12.00/hour

- January 1, 2020: $13.50/hour

The new Washington minimum wage law does not supplant local wage laws enacted in various cities, so many employers will still need to ensure compliance with federal, state and local requirements.

Local Minimum Wage Updates

Seattle:

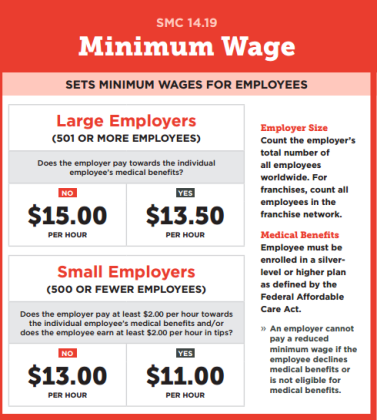

Seattle’s Minimum Wage officially climbs to $15/hour for large employers. Effective January 1, 2017, the minimum wage rates and minimum compensation scheme in Seattle will be as follows:

Source: Seattle Office of Labor Standards

As a reminder, employers must post information in English and Spanish (and possibly additional languages) about the Seattle minimum wage, paid sick and safe leave, wage theft, and fair chance employment ordinances.

Other Cities:

Effective January 1, 2017, the minimum wage in Tacoma and SeaTac will rise as follows:

- Tacoma: $11.15/hour

- City of SeaTac: $15.34/hour (for certain hospitality and transportation employers)

Initiative 1433: State Paid Sick Leave (and Comparison to Local Ordinances)

Effective January 1, 2018, Initiative 1433 requires all Washington employers to provide paid sick leave, regardless of the employer’s size. Here is a summary of the key components of the sick leave law, and how it compares to requirements in other Washington cities with paid sick leave laws:

|

|

Washington Paid Sick Leave under Initiative 1433 (effective 1/1/18) |

Seattle |

Tacoma |

Spokane (effective 1/1/17) |

|

Effective Dates |

January 1, 2018 |

Ongoing |

Ongoing |

Jan. 1, 2017 until implementation of I-1433 |

|

Employer Size |

No minimum: 1+ |

Tier 1: 5-49 Tier 2: 50-249 Tier 3: 250+ |

1+ |

1+ |

|

Employer Location |

Silent (awaiting guidance in final rules) |

Anywhere |

Anywhere |

Must have physical location in Spokane |

|

Employees Covered |

As defined in RCW 49.46.010 |

Employees who perform more than 240 hours of work in Seattle within a calendar year |

Employees who perform more than 80 hours of work in Tacoma within a calendar year |

Employees who perform more than 240 hours of work in Spokane within a calendar year |

|

Exclusions |

As defined in RCW 49.46.010 |

Work-study students, independent contractors, and government workers (other than City of Seattle employees) |

Work-study students, independent contractors, single-person businesses, and government workers |

Work-study students, independent contractors, single-person businesses, government workers, seasonal and domestic workers, and certain construction |

|

Accrual |

1 hour for every 40 hours worked

|

Tier 1 and 2: 1 hour for every 40 hours worked Tier 3: 1 hour for every 30 hours worked

No maximum accrual

|

1 hour for every 40 hours worked

|

1 hour for every 30 hours worked in Spokane

No guidance as to accrual cap

Accrual for exempt employees tied to normal work week

Employer must provide information about employee’s balance and use every pay period |

|

Rollover (max) |

40 hours |

Tier 1: 40 hours Tier 2: 56 hours Tier 3: 72 hours |

24 hours |

24 hours for employers with 1-9 employees

40 hours for employers with 10+ employees |

|

Use: Annual Max |

Silent as to cap on use (awaiting guidance in final rules) |

Tier 1: 40 hours Tier 2: 56 hours Tier 3: 72 hours |

40 hours |

24 hours for employers with 1-9 employees

40 hours for employers with 10+ employees |

|

Use: Increments |

Silent (awaiting guidance in final rules) |

Smaller of hourly increments or, if feasible, 15-minute increments |

1-hour increments unless employer establishes written minimum use policy |

1 hour minimum increments |

|

Use: Waiting Period |

90 days |

180 days |

180 days |

90 days |

|

Use: Purposes |

Employee’s own mental or physical illness, injury, or medical condition; medical diagnosis, care, or treatment, including preventative care Care for employee’s family member. “Family member” broadly defined to include: (a) Child (biological, adopted, foster, stepchild, or child to whom employee is legal guardian, de facto parent, or stands in loco parentis), regardless of age or dependency status. (b) Parent of employee or employee’s spouse or registered domestic partner (biological, adoptive, de facto, foster, stepparent, legal guardian, or person who stood in loco parentis when employee was a minor child); (c) Spouse; (d) Registered domestic partner; (e) Grandparent; (f) Grandchild; or (g) Sibling

Closure of employee’s workplace, or employee’s child’s school or care provider, for health-related reason by order of public official

Domestic violence leave |

Same purposes as state law

|

Same purposes as state law plus bereavement leave for death of family member |

Same purposes as state law plus bereavement leave for death of family member

|

|

Verification |

More than 3 consecutive days |

More than 3 consecutive days or pattern of abuse |

Employer may take reasonable measures to verify use of leave; must have written policy regarding documentation requirements |

No limitations |

|

Pay Out Upon Separation |

Employer not required to pay out accrued but unused sick leave at termination |

Same as state law

|

Same as state law

|

Same as state law

|

|

Reinstatement of Accruals |

If employee is rehired within 12 months of separation, previous balance must be reinstated |

Reinstatement if rehired within 7 months of separation |

Reinstatement if rehired within 6 months in the same calendar year of separation |

Not required |

|

Notice of Absence |

Employer may require employee to provide reasonable notice of absence |

Foreseeable leave: written request at least 10 days in advance or as early as possible

Unforeseeable leave: notice as soon as practicable, complying with employer’s call-in procedures |

Foreseeable leave: written request at least 10 days in advance or as early as possible

Unforeseeable leave: notice as soon as practicable, complying with employer’s call-in procedures |

Advance notice not addressed, but request should specify employee’s reasonable estimate of duration

|

|

Attendance Policies |

Employer prohibited from maintaining policies that count use of paid sick leave as absence for disciplinary purposes |

Employer generally may not count any absence covered by the ordinance for disciplinary purpose, but may discipline for clear instance or pattern of abuse |

Employer generally may not count any absence covered by the ordinance for disciplinary purpose, but may discipline for clear instance or pattern of abuse |

No specific guidance |

As with the minimum wage, many Washington employers will find themselves subject to overlapping paid sick leave laws that are confusingly similar yet not completely identical. For example, while most paid sick leave ordinances cap annual accrual and use, Initiative I-1433 caps neither (but does cap maximum rollover). Similarly, many employers familiar with the Washington Family Care Act (WFCA) will observe that Initiative I-1433 defines “family” much more broadly than the WFCA, meaning employees will be able to use sick leave for paid family care in a wider range of circumstances (including care for the employee’s adult children and siblings).

One of the concerns about passing employment laws by initiative is that Initiative 1433 predictably contains many gaps and ambiguities, which will hopefully be addressed when the Department of Labor and Industries issues interpretive rules. For instance, Initiative 1433 completely ignores the fact that many employers offer Paid Time Off (PTO) programs rather than dedicated sick leave. The law contains not a single reference to PTO, and accordingly fails to address how employers with PTO programs should ensure compliance with the new requirements. In addition, unlike local ordinances, Initiative 1433 lacks an express exception to the three-consecutive-day rule for verification in cases of suspected sick leave abuse.

A note for employers with no-fault attendance policies: Employers with no-fault attendance policies will need to consider how to adapt given the law’s prohibition on policies that count use of paid sick leave as absences for disciplinary purposes.

A note about payout at separation: While the Initiative does not require payout of accrued but unused sick leave upon separation, be sure that your written policies could not be interpreted otherwise to avoid the risk of potential contract issues.

A note for employers with employees represented by labor organizations: Initiative 1433 does not permit its wage or sick leave provisions to be waived in a collective bargaining agreement.

Practice Tips: What Should Employers Do Now

- Ensure payroll has made any necessary changes to implement new minimum wage rates for 2017.

- Employers with employees in Seattle, Tacoma, or Spokane must ensure they have sick leave policies in place for 2017 that comply with the applicable local ordinance(s).

- Later this year, employers should revise any employee handbooks or sick leave policies to ensure compliance with the new sick leave law. Employers may choose to have one policy for all of Washington – providing the most generous aspects of the sick leave requirements that apply to their workforce – or have separate policies for each City with its own requirements.

- Employers with multi-state or statewide workforces are encouraged to contact legal counsel to ensure sick leave policies are compliant with applicable local and state requirements.