The first investor money raised by startups is most frequently raised through the sale of convertible notes. While a simple instrument to sell in comparison to equity, there are still several terms a startup founder needs to consider when selling convertible notes in order to make them attractive to investors. One of most commonly discussed terms is the valuation cap, but what is a valuation cap?

Convertible notes are designed to convert into stock of the issuing company upon the subsequent sale of preferred stock in excess of a certain dollar threshold, which is usually referred to as a "qualified financing." For example, a qualified financing may be defined as the sale of more than $1 million of preferred stock.

In order to make a note investment attractive to investors the notes will generally convert at a cap or discount. Without a cap or discount, the notes would typically convert into the issuing company's preferred stock in the qualified financing at the same price as the preferred stock issued in that financing, which would not be an attractive investment to investors because they would not receive any benefit for being an early investor.

What Is a Discount?

A discount is simply a percentage discount on the per share price of stock sold in a financing. For example, if a note is sold with a 20 percent discount and the company sells shares of Series A Preferred Stock in a qualified financing for $1 per share, then the outstanding balance on the note at the time of the qualified financing would convert into shares of Series A Preferred Stock at a price of $0.80 per share.

How Does a Valuation Cap Work?

A "valuation cap" entitles note holders to convert the outstanding balance on the note into shares of stock at the lower of (i) the valuation cap or (ii) the price per share in a qualified financing (or, if there is a discount in the note, then the discounted price per share). It is not a valuation of the company based on the company's current projections or assets. It is intended to ensure that an investor does not miss out on significant appreciation of a company between the time of the sale of convertible notes and the qualified financing.

In all fairness, the investor should have some comfort that if an investment is made when the company has very little value, that the note will not convert at an astronomical valuation and thereby deprive the investor of participating in all the upside that was made possible by the early investment.

Cap Illustration: Let's take a situation where a startup sold $100,000 of convertible notes with no discount, interest at 8 percent, and a valuation cap of $5 million that automatically converts upon a qualified financing of at least $1 million. Six months after the notes are issued the startup sells $2 million in Series Seed Preferred Stock on a pre-money valuation of $8 million.

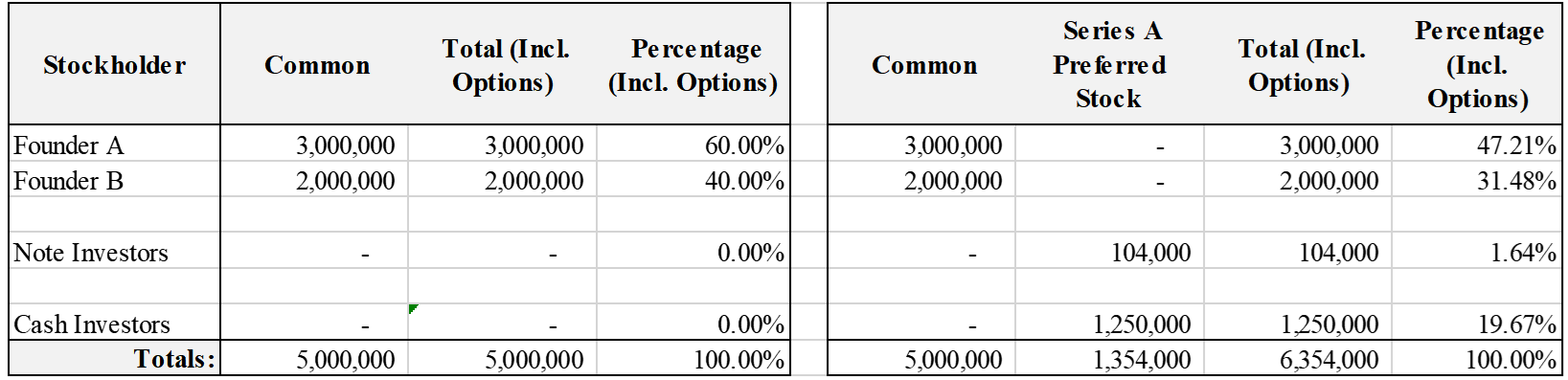

Here is what a typical pre and post financing cap table could look like assuming, for purposes of simplicity, that no option pool is included:

What Happened to the Convertible Notes?

The convertible notes, including 8 percent interest for six months of $4,000, converted into shares of Series A Preferred at a capped price of $1 per share. The capped share price was determined by dividing the capped valuation of $5 million divided by the 5 million shares outstanding immediately prior to the financing to come up with $1 per share.

In contrast, the new cash investors will pay $1.60 per share, which is determined by dividing the negotiated pre-money valuation of $8 million by the 5 million shares outstanding immediately prior to the financing. So, as you can see, the noteholders receive a significant benefit due to the conversion cap in the note as the noteholders in this illustration are receiving a significant discount on the per share price paid by the new money investors in the round.

If the convertible notes were issued with a 20 percent discount and no cap, then the convertible notes would have converted into 81,250 shares. The math on this calculation is as follows: ($100,000 principal + $4,000 of interest)/(80% x $1.60) = 81,250 shares. This illustration highlights why many investors pursue both caps and discounts.

What Is the Investor's Position?

Investors often will negotiate to include a cap in a convertible note because it is the investors' early investment that allowed the company to achieve the high pre-money valuation in the Series A Preferred Stock financing, so they should benefit from the cap in the situation where there is significant increases in valuation between the time notes are issued and the qualified financing.

Valuation caps really help ensure early investors are rewarded in crazy situations where, for example, the valuation goes up 5-10x. In these situations, without a cap the early investors would not be adequately rewarded for their risk. They need a cap to put a floor on their price to ensure they are rewarded.

What Is the Founders' Position?

Valuation caps can be a pain because they are one more thing to negotiate. One of the reasons to sell a convertible note versus stock is to avoid having to set a value for the company. If the cap is supposed to represent the current value of the company (a typical, albeit incorrect, investor view), then founders have not accomplished putting off the valuation negotiation at all, and it is possible founders might get bogged down in negotiating over it.

Additionally, should there be a discount and no cap, there is still significant investor upside. In most situations a discount on the subsequent round will reward those investors. For example, a convertible note with a 20 percent discount and 8 percent interest, but no cap, that is outstanding for one year will still result in a 35 percent one year return for an investor. The math, for those into the math, is this:

($100 investment + $8 interest) / (1 – 20% discount) = 1.35 (or 135%)

Caps Are NOT Valuations

Founders should not let investors get away with the argument that caps are valuations. If founders and investors were setting the valuation, then they should be doing an equity round. Caps protect investor's upside risk by setting a floor on their purchase price, but they are not valuations.

What Is the Bottom Line?

Caps seem to be a necessary evil when raising convertible notes in the current climate especially for raising initial investor money. However, the use and need for a cap decreases significantly for later bridge financings. For example, if a startup has already raised a Series A and a Series B, but wants to raise a small amount of money to bridge capital needs before doing a Series C round, caps are included much less frequently.